KLA: A Quick Update

KLA Corp is poised for strong growth driven by TSMC’s increased capex, surging AI-driven semiconductor demand, and its critical role in advanced chip manufacturing.

Dear readers,

Welcome back to the Quality Equities newsletter.

On November 16, 2024, I published an article titled “KLA: This High-Quality Company Looks Cheap”. In this article, I contended that KLAC 0.00%↑ KLA's shares presented a compelling investment opportunity, as I believed the market was overlooking the immense potential of this high-quality company.

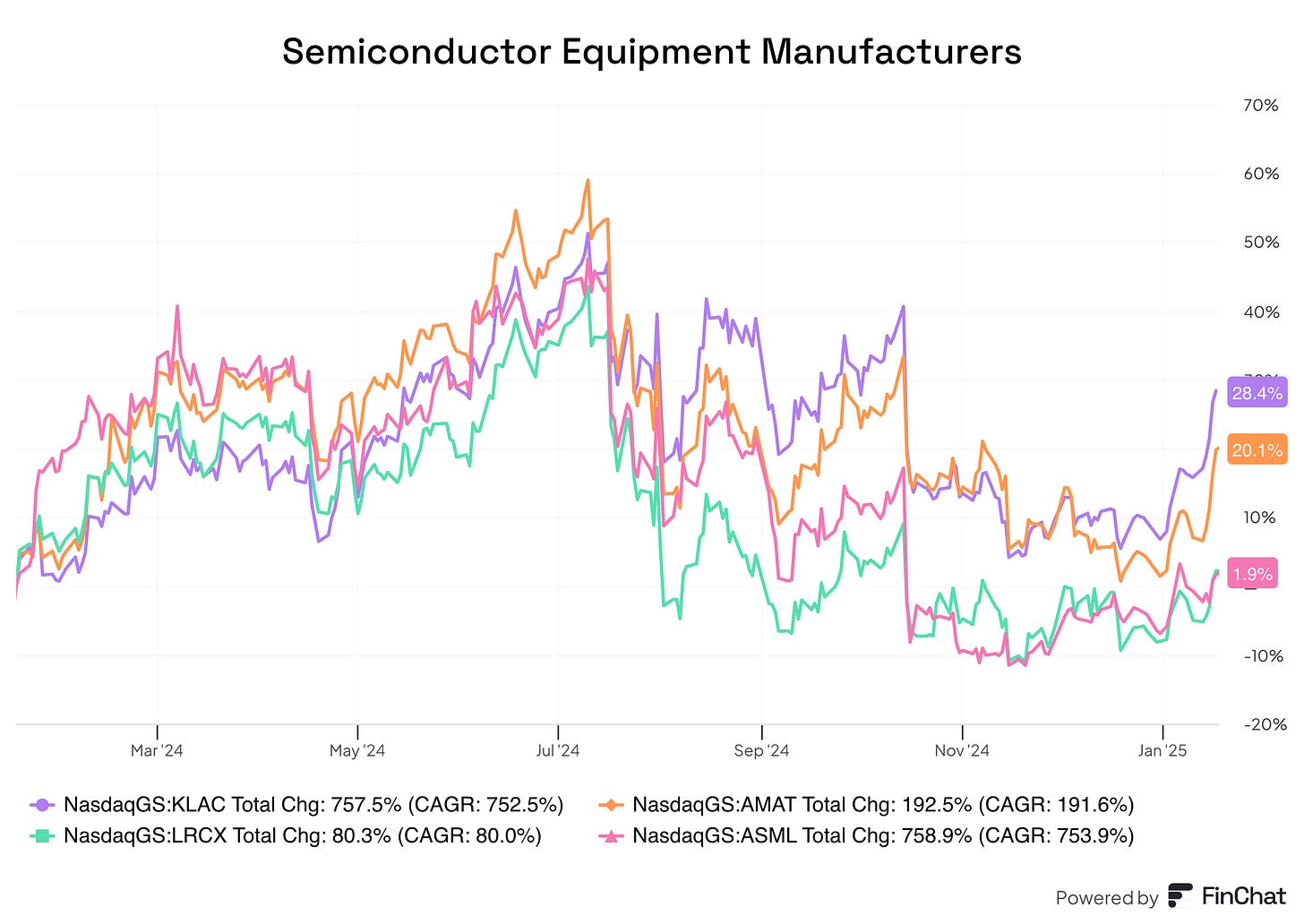

Since then, KLA has been on a strong upward trajectory, benefiting from tailwinds in the semiconductor industry. The stock recently surged, reflecting investor optimism driven by a mix of strong industry fundamentals and positive macro developments. Other semiconductor equipment giants, including AMAT 0.00%↑ Applied Materials, LRCX 0.00%↑ Lam Research, and ASML 0.00%↑ ASML, have also seen a similar surge recently. Since publishing my original article, KLA shares have rallied roughly 23%.

KLA’s Recent Stock Surge

This past week, KLA's stock saw a strong rally, closing at $757.47 on Friday, bringing its year-to-date gain in 2025 to an impressive 20.21%. The rally was fueled by broader strength in semiconductor stocks following TSM 0.00%↑ Taiwan Semiconductor Manufacturing Company’s TSMC strong earnings report. As a leading supplier of process control and yield management equipment for chipmakers, KLA stands to benefit from increased wafer production and capital expenditures in the sector.

TSMC’s Capex Boost: A Growth Catalyst for KLA

TSMC, the world’s largest contract chipmaker, announced a higher-than-expected capital expenditure (capex) budget for 2025, forecasting $38 billion to $42 billion in investments. This marks a significant increase from $29.8 billion in 2024, signaling robust demand for semiconductor equipment.

For KLA, this is a strong bullish indicator. Since the company supplies inspection and metrology tools critical for chip production, higher spending from TSMC, alongside investments from Samsung and INTC 0.00%↑ Intel, should translate into increased orders for KLA’s equipment. CEO Rick Wallace previously emphasized that demand for advanced process control solutions is surging, particularly as AI-related chips require stricter quality control and yield optimization.

AI Boom Driving Structural Growth

The AI revolution continues to be a powerful force behind semiconductor demand. Leading players like NVDA 0.00%↑ NVIDIA and AMD 0.00%↑ AMD are designing AI accelerators that require cutting-edge semiconductor manufacturing capabilities. The need for higher transistor density and defect-free wafer production is growing, making KLA’s technology more critical than ever.

Wall Street analysts have pointed out that KLA’s exposure to AI-driven semiconductor growth puts the company in a strong position for sustained revenue expansion. The company’s recent revenue guidance of $2.95 billion for the current quarter, exceeding analyst estimates, suggests confidence in its near-term growth trajectory.

Conclusion

With TSMC’s capex expansion, growing AI-driven semiconductor demand, and KLA’s strong market position, the company is well-positioned for future growth. While macroeconomic risks and cyclical downturns remain potential headwinds, the long-term trend of increasing semiconductor complexity and production bodes well for KLA’s continued success.

Investors looking for exposure to the AI and semiconductor equipment boom may find KLA an attractive play, especially as leading foundries ramp up spending to meet the ever-growing demand for high-performance computing chips.