Three Quality Companies to Buy Today

In volatile markets marked by fear, uncertainty, and doubt, it's more important than ever for investors to stay focused on investing in high-quality, long-term opportunities.

Dear readers,

Welcome back to the Quality Equities newsletter.

This past week, US stock markets ended slightly lower as investors digested mixed signals from the economy and geopolitical developments. The S&P 500 slipped 0.5%, the Dow Jones fell 0.3%, and the Nasdaq remained mostly flat. Small caps also lagged slightly, with the Russell 2000 down 0.2%. The overall tone was cautious as markets awaited further clarity on US-China trade dynamics and upcoming economic data.

Trade tensions were a central focus. Although President Trump floated the idea of reducing tariffs on Chinese imports, uncertainty persisted, particularly around whether a meaningful trade resolution could be reached. Investors remained wary that continued friction could dampen global growth and push the US closer to recession territory. Meanwhile, the Fed kept interest rates steady, offering no surprises but leaving markets watchful for any future signals amid political pressure and economic crosscurrents.

On the economic front, US GDP contracted 0.3% in the first quarter, mainly due to a sharp rise in imports ahead of potential tariff hikes. However, the labor market showed ongoing strength, with 177,000 jobs added in April and the unemployment rate holding steady at 4.2%. These mixed signals left investors uncertain about the trajectory of both inflation and interest rates.

In volatile markets marked by fear, uncertainty, and doubt, it's more important than ever for investors to stay focused on high-quality, long-term opportunities. In today’s article, I highlight three companies that I believe offer fair valuations and strong potential for sustained growth.

Intuit

First up is INTU 0.00%↑ Intuit. In my view, Intuit presents a compelling case for long-term investment due to its combination of a durable competitive moat, recurring revenue model, and expanding ecosystem across consumer and business financial services.

The company is best known for its flagship products (such as TurboTax, QuickBooks, Credit Karma, and Mailchimp) which together serve individuals, small businesses, and the self-employed. These platforms are deeply embedded in users' workflows, driving high customer retention and strong pricing power. QuickBooks, in particular, has become mission-critical software for millions of small businesses, while TurboTax remains the dominant player in consumer tax filing. This stickiness and brand trust are key components of Intuit’s moat.

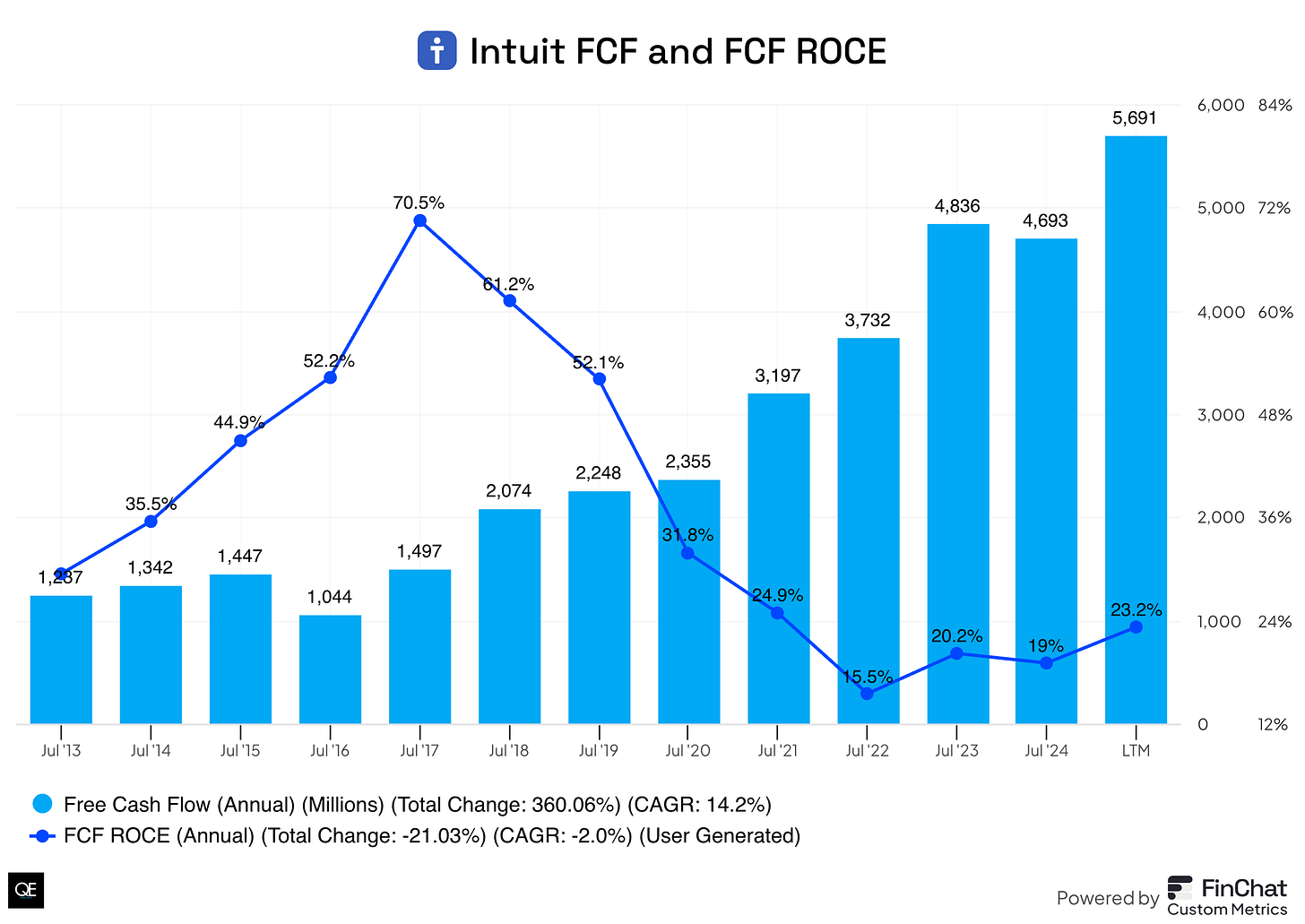

Financially, Intuit is a capital-light business with high operating margins and robust free cash flow generation. Its transition to a SaaS-based model delivers recurring revenue and enables steady reinvestment into product innovation and AI-based automation. The company is also shifting toward integrated platform solutions, using its large user base and data insights to cross-sell services and deepen customer relationships. This approach has helped expand its average revenue per user ARPU and drive consistent revenue and earnings growth, even in volatile macro environments.

Growth opportunities remain significant. Intuit is expanding globally and pushing into new adjacencies like mid-market accounting, fintech lending, and AI-driven business tools. Credit Karma and Mailchimp add reach into consumer finance and digital marketing, respectively, offering both synergy and optionality. While risks include competition from newer fintechs, regulatory changes, and reliance on seasonal tax revenue, Intuit’s dominant market position, network effects, and robust financial profile help mitigate these concerns.

Intuit’s current valuation isn’t incredibly demanding at a 3.11% FCF yield, especially for a company that’s expected to grow earnings at a CAGR greater than 20% over the next five years. Overall, Intuit’s blend of predictability, pricing power, and long runway for growth make it an attractive compounder for long-term investors.

Meta Platforms

Next is META 0.00%↑ Meta Platforms. Meta (my largest holding as of this writing) presents a compelling long-term investment opportunity due to its unparalleled global scale in social networking, significant free cash flow generation, and growing leadership in digital advertising and AI capabilities.

As the parent company of Facebook, Instagram, WhatsApp, and Messenger, Meta reaches more than 3.4 billion daily users, giving it unmatched distribution and engagement. This user base, paired with sophisticated ad targeting capabilities, has made Meta one of the most effective platforms for digital advertisers, allowing it to command premium ad pricing and maintain strong margins even in cyclical downturns.

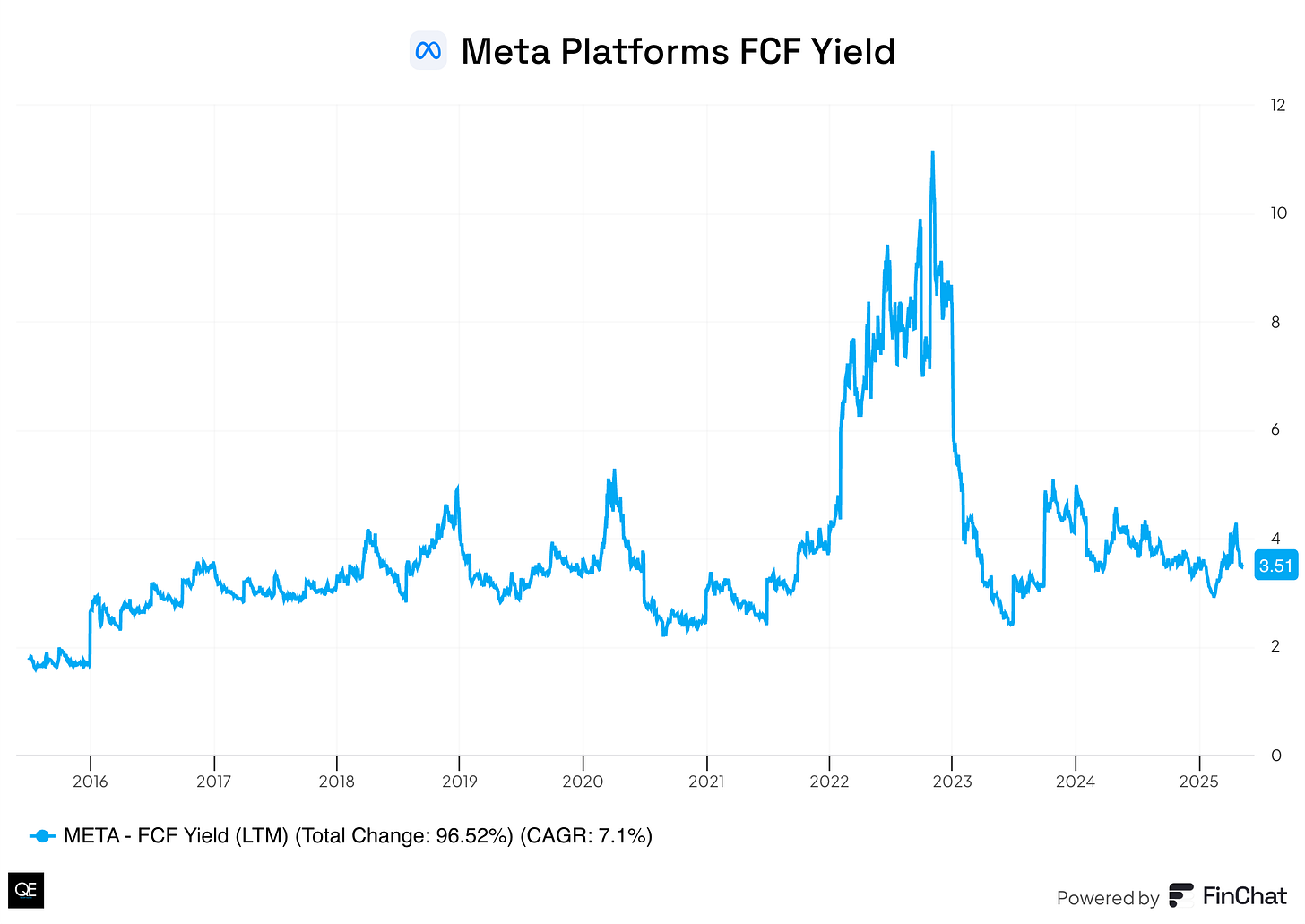

Financially, Meta is a cash machine. It generates tens of billions in free cash flow annually, driven by its capital-efficient core ad business. This strong profitability enables heavy reinvestment into future-facing technologies like artificial intelligence, recommendation algorithms, and its long-term bet on the metaverse. While the metaverse remains speculative, Meta’s Reality Labs division is supported by a fortress balance sheet and the cash flow of its core business, giving the company optionality without threatening near-term fundamentals.

Meta’s ongoing investment in AI is enhancing its core platforms, improving user experience and ad performance while enabling new monetization formats like click-to-message and AI-driven shopping. Additionally, newer monetization channels (such as Reels, Threads, business messaging, and WhatsApp payments) are still in early innings and offer a long runway for incremental revenue growth. Risks include regulatory scrutiny, competition from platforms like TikTok, and the uncertain return on metaverse investments.

However, with one of the most scalable platforms on earth, strong pricing power in digital ads, and a proven track record of adapting to platform shifts, Meta remains a dominant and adaptable tech titan well-positioned for compounding returns. A 3.51% FCF yield isn’t too demanding.

S&P Global

Last, but not least, is SPGI 0.00%↑ S&P Global. S&P Global is a high-quality, wide-moat business that makes a strong case for long-term investment thanks to its critical role in the global financial system, diversified revenue streams, and scalable, capital-light model. Best known for its credit ratings business, indices, and financial data services, S&P Global operates in segments that are deeply embedded in global capital markets infrastructure.

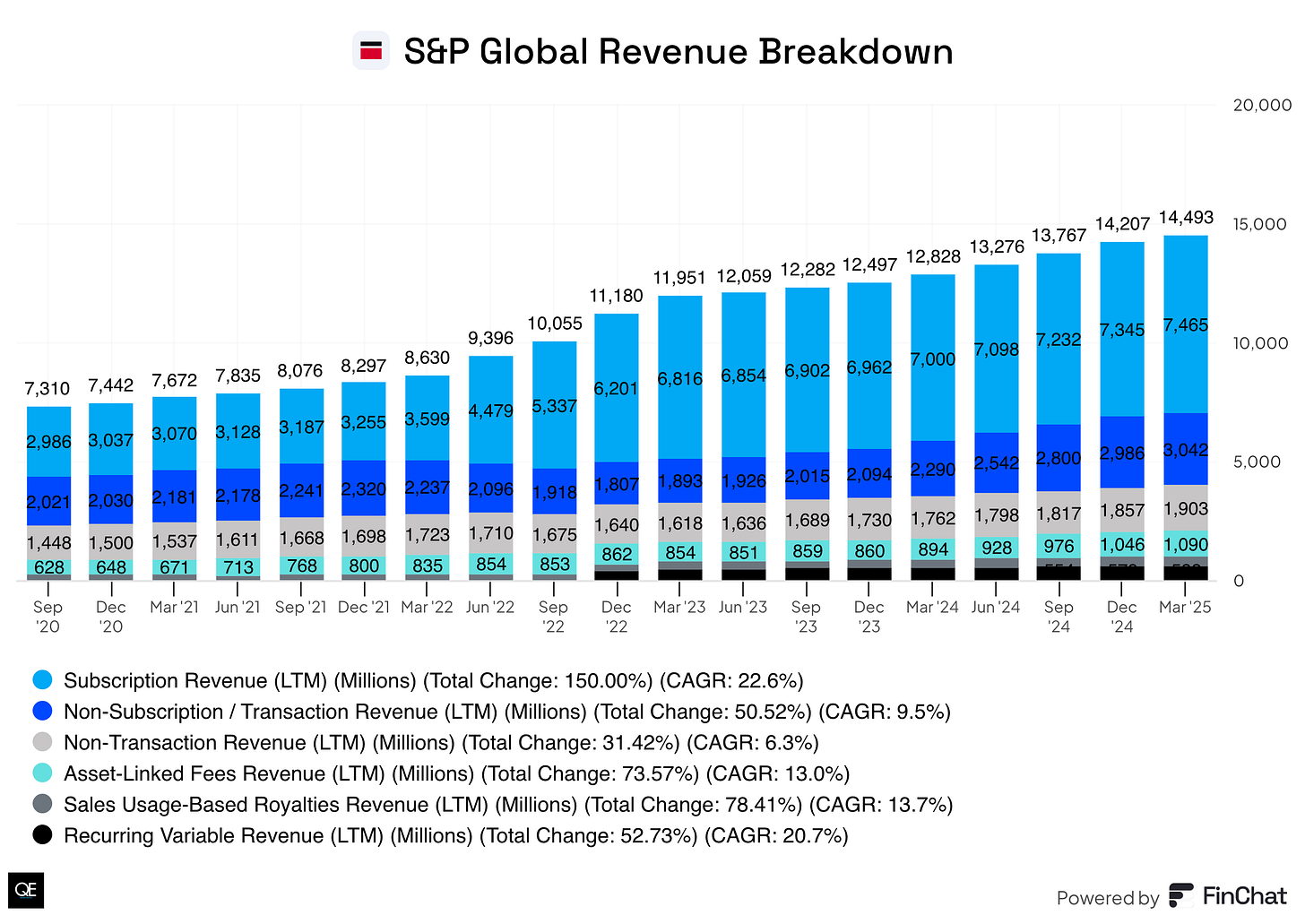

Its ratings division is essential for debt issuance, while its indices, such as the S&P 500, underpin trillions of dollars in passive investment products. These services are not easily replicated and provide substantial pricing power and recurring revenue.

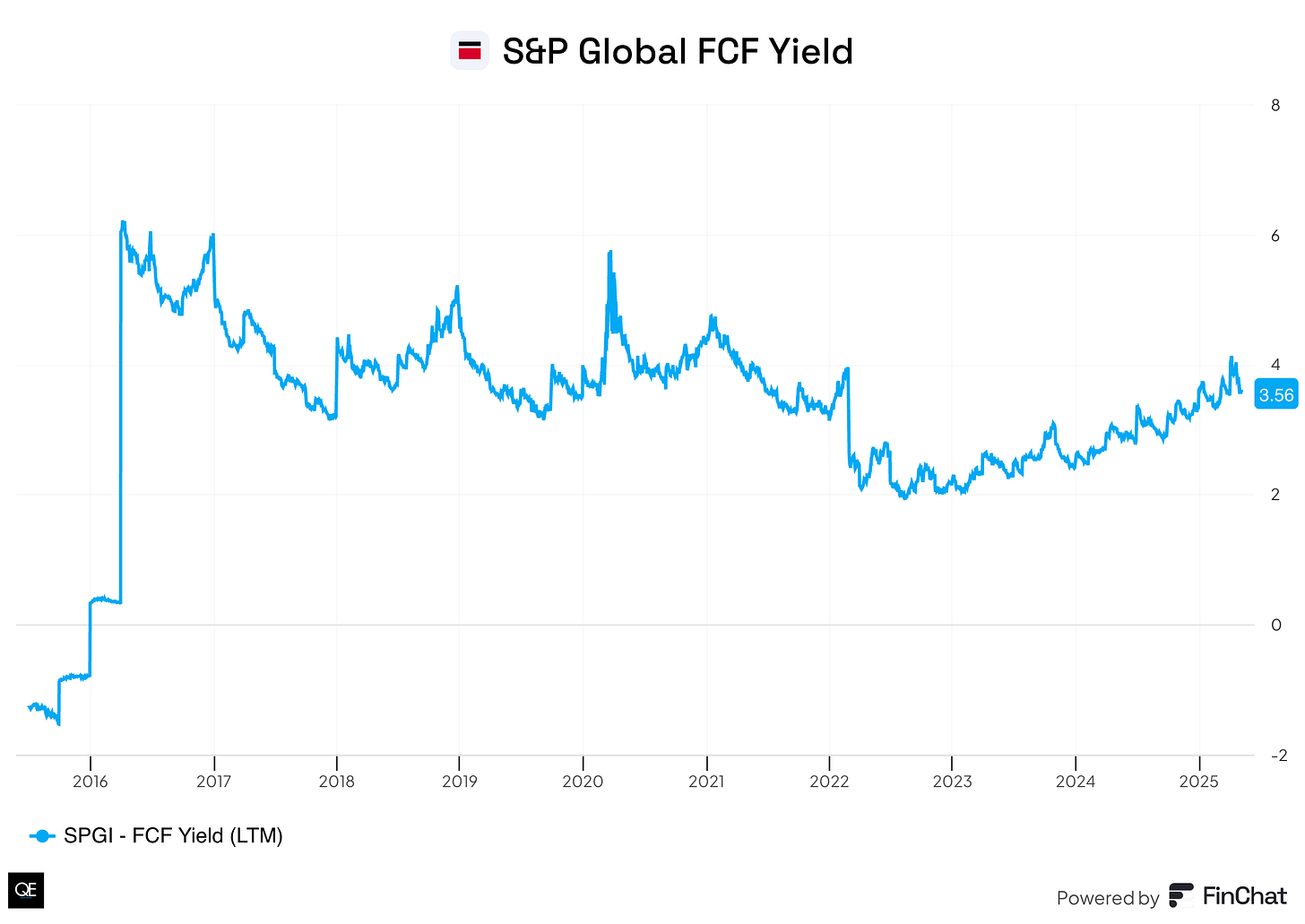

The company has expanded significantly beyond ratings, with major business lines now including market intelligence (data & analytics), indices (via S&P Dow Jones Indices), and commodity/energy analytics (Platts). These segments are high-margin, subscription-based, and benefit from strong secular trends like the growth of data-driven investing, increased regulatory requirements, and ESG adoption. With low capital expenditure requirements and high operating leverage, S&P Global generates substantial free cash flow, which it has historically used for share repurchases, dividends, and bolt-on acquisitions.

S&P Global’s recent decision to spin out its mobility business reflects a strategic move to sharpen its focus on core high-margin, data-driven segments (such as ratings, indices, and financial intelligence) while unlocking value from a non-core asset. The mobility division, inherited from the IHS Markit acquisition, operates in a slower-growth, more cyclical automotive information space that doesn’t align as tightly with S&P’s financial markets focus. By divesting it, S&P can streamline operations, concentrate capital allocation on its core franchises, and potentially allow the mobility unit to pursue growth opportunities more effectively as a standalone entity.

While there are risks, such as potential regulatory constraints on the ratings business or competition in data services, the company's entrenched position, mission-critical offerings, and consistent execution make it a resilient and durable compounder. Its ability to grow earnings (likely at a CAGR in the mid to high teens over the next five years) through a combination of organic growth, operating leverage, and disciplined capital allocation supports a long-term investment thesis centered around stability, scalability, and pricing power. As an investor, I think a FCF yield of 3.56% is reasonable for such a high-quality, predictable business model.

Not for Everyone.

But maybe for you and your quality investing loving patrons?

Hello QE ,

I hope thid finds you in a rare pocket of stillness.

We hold deep respect for what you've built here—and for how.

We’ve just opened the door to something we’ve been quietly handcrafting for years.

Not for mass markets. Not for scale. But for memory and reflection.

Not designed to perform. Designed to endure.

It’s called The Silent Treasury.

A sanctuary where truth, judgment, and consciousness are kept like firewood—dry, sacred, and meant for long winters.

Where trust, vision, patience, and stewardship are treated as capital—more rare, perhaps, than liquidity itself.

The 3 inaugural pieces speak to quiet truths we've long engaged with:

1. Why many modern investment ecosystems (PE, VC, Hedge, ALT, spac, rollups) fracture before they root

2. Why Judgment, ‘Signal’, and Trust Migrate Toward Niche Information Sanctuaries

3. The Hidden Costs of Clarity Culture — for long term, irreversible decisions

These are not short, nor designed for virality.

They are multi-sensory, slow experiences—built to last.

If this speaks to something you've always felt but rarely seen expressed,

perhaps these works belong in your world.

Two sample publication links are enclosed, should you choose to start experiencing…

https://open.substack.com/pub/helloin/p/from-brightness-to-blindness-the?utm_source=share&utm_medium=android&r=5i8pez

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

Are you deducting SBC from FCF? GIven Intuit's high SBC, I don't believe its FCF is that high.